[To see a detailed monthly amortization schedule and to calculate loan payback scenarios specific to your circumstances, please use the following file]

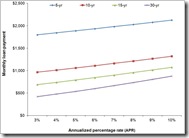

The limiting selection factor for most borrowers is how much money they can reasonably afford to pay each month. The chart to the left shows the monthly payment associated with borrowing $100,000 at various interest rates and loan durations. Longer-term loans are associated with lower monthly payments, but as we have already seen, these loans are also associated with greater total interest paid. Because of the increased interest paid, APR exerts a systematically greater influence on the total monthly payment amount as the loan duration increases.

The limiting selection factor for most borrowers is how much money they can reasonably afford to pay each month. The chart to the left shows the monthly payment associated with borrowing $100,000 at various interest rates and loan durations. Longer-term loans are associated with lower monthly payments, but as we have already seen, these loans are also associated with greater total interest paid. Because of the increased interest paid, APR exerts a systematically greater influence on the total monthly payment amount as the loan duration increases.

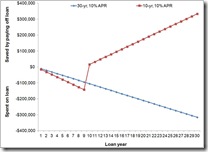

Although APR is largely out of our control, the decision of which loan to select is within our control; however, we rarely select the loan that is in our long-term best interests because we react with a short-term affordability mindset. Two common arguments for selecting longer-term loans are that lower monthly payments increase available cash flow and that home values depreciate. However, upon closer examination, neither argument holds water. Reduced monthly payments only provide the appearance of increased cash flow, but in actuality are more costly. For example, a 10% APR loan for $100,000 with a 30-year payoff appears to save $444 monthly relative to a 10% APR loan for the same amount with a 10-year payoff; however, the savings for the 30-year loan after the first 10 years is only $53,273. This same amount of money is then ‘saved’ by the person with the 10-year loan by not having to make a loan payment at all during the first 3.4 years after the 10-year loan is paid off. During the next 16.6 years that the person with the 30-year loan is still making monthly payments, the person with the 10-year loan saved another $279,748.

amount with a 10-year payoff; however, the savings for the 30-year loan after the first 10 years is only $53,273. This same amount of money is then ‘saved’ by the person with the 10-year loan by not having to make a loan payment at all during the first 3.4 years after the 10-year loan is paid off. During the next 16.6 years that the person with the 30-year loan is still making monthly payments, the person with the 10-year loan saved another $279,748.

Also, it is important to remember that home values fluctuate regardless of whether or not you’re making payments on a loan. As such, the person that chooses to invest less in their home is by default opting to give more of their hard-earned money to the bank and less to themselves. In turn, this person actually loses the most if the home value should decline because they’ve (a) spent more to begin with and (b) they have less equity when the home is sold, which the only time that ‘value’ actually matters.

Another common practice that is made when purchasing a loan, particularly a long-term loan, is to put as much into a down payment as possible to lower the total amount borrowed, and in turn, the total monthly payment. However, for borrowers with the ability to make a larger down payment than the minimum down payment required by the lender, the following strategy is advised: hold back some of the ‘extra’ down payment money and apply it as extra principal in the first monthly loan payment to shift the loan considerably forward in the payback schedule. Although this strategy does not exceed the benefits of a shorter duration loan, it does offer a faster payback time and reduced total interest paid all while enabling a lower monthly payment. This approach is particularly appealing if a loan term between 15 and 30 years is not available.

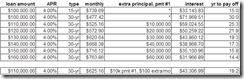

As evidenced by the comparison table below calculated for a 4% APR loan for various borrowed amounts and payback strategies, the most effective strategy for reducing interest and payback time is to aggressively shift the payback schedule forward early on in the amortization schedule.

The suggestions conveyed herein are intended to provide a general guide to assist in helping you shed large monthly financial obligations that may currently preclude you from being able to afford to implement changes in your home or life which will reduce your ecological footprint.

Similar to energy audits, if you’re intimidated by numbers and computations, click here to have Eco-Cents crunch the data for you for a small fee.