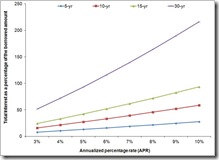

The proportion of interest to principal associated with monthly payments is a reflection of both the APR as well as the duration of the loan. Lower interest rates and shorter-term loans are associated with the least amount of interest paid. However, the extent to which higher APRs result in greater total interest paid is exacerbated by loan duration. For example, the total interest as a function of the loan amount for a five year loan only increases from 7.8% (i.e., $7,800 paid in interest for every $100,000 borrowed) at a 3% APR to 27.5% for a 10% APR. In contrast, the total interest paid on a 30-year loan ranges from 51.7% to 215.9% between 3% and 10% APR, respectively.

The proportion of interest to principal associated with monthly payments is a reflection of both the APR as well as the duration of the loan. Lower interest rates and shorter-term loans are associated with the least amount of interest paid. However, the extent to which higher APRs result in greater total interest paid is exacerbated by loan duration. For example, the total interest as a function of the loan amount for a five year loan only increases from 7.8% (i.e., $7,800 paid in interest for every $100,000 borrowed) at a 3% APR to 27.5% for a 10% APR. In contrast, the total interest paid on a 30-year loan ranges from 51.7% to 215.9% between 3% and 10% APR, respectively.

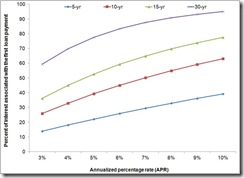

A greater range in the distribution of monthly interest charges as a function of APR is also affiliated with longer duration loans. For example, the proportion of the first monthly payment associated with interest for a 30-year loan over an APR range of 3% to 10% varies from 59.3% to 95.0%, respectively. However, for a five-year loan, the percent of the first monthly payment associated with interest ranges from 13.9% (3% APR) to 39.2% (10% APR). Not surprisingly then, the number of years to reach the point at which more of the monthly payment is applied to principal than to interest is therefore inherently related to the interest proportion starting point. Consequently, making extra principal payments early in the life of the loan is most advantageous for long-duration loans at higher APRs, and is the subject of the next section.

percent of the first monthly payment associated with interest ranges from 13.9% (3% APR) to 39.2% (10% APR). Not surprisingly then, the number of years to reach the point at which more of the monthly payment is applied to principal than to interest is therefore inherently related to the interest proportion starting point. Consequently, making extra principal payments early in the life of the loan is most advantageous for long-duration loans at higher APRs, and is the subject of the next section.